All Categories

Featured

Table of Contents

There is no one-size-fits-all when it comes to life insurance policy./ wp-end-tag > In your busy life, monetary freedom can seem like a difficult goal.

Less employers are providing typical pension plan plans and several firms have actually minimized or stopped their retired life strategies and your ability to rely exclusively on social protection is in inquiry. Even if benefits have not been reduced by the time you retire, social safety and security alone was never intended to be sufficient to pay for the lifestyle you want and are entitled to.

/ wp-end-tag > As part of an audio monetary method, an indexed global life insurance coverage plan can help

you take on whatever the future brings. Before dedicating to indexed universal life insurance, right here are some pros and disadvantages to consider. If you pick a good indexed global life insurance policy strategy, you might see your cash value expand in worth.

Universal Life Insurance Policy Quotes

Because indexed global life insurance coverage requires a certain level of risk, insurance coverage companies often tend to keep 6. This type of plan also provides.

Typically, the insurance company has a vested passion in executing far better than the index11. These are all variables to be taken into consideration when choosing the ideal kind of life insurance policy for you.

What Is The Difference Between Whole Life Insurance And Universal Life Insurance

However, because this type of policy is a lot more complicated and has an investment component, it can typically come with greater costs than various other plans like whole life or term life insurance policy. If you do not believe indexed universal life insurance coverage is best for you, below are some alternatives to think about: Term life insurance policy is a temporary plan that normally supplies coverage for 10 to 30 years.

Indexed global life insurance policy is a kind of policy that provides extra control and versatility, along with greater cash money value development possibility. While we do not supply indexed universal life insurance, we can give you with even more info concerning entire and term life insurance plans. We suggest discovering all your alternatives and talking with an Aflac representative to discover the most effective fit for you and your family.

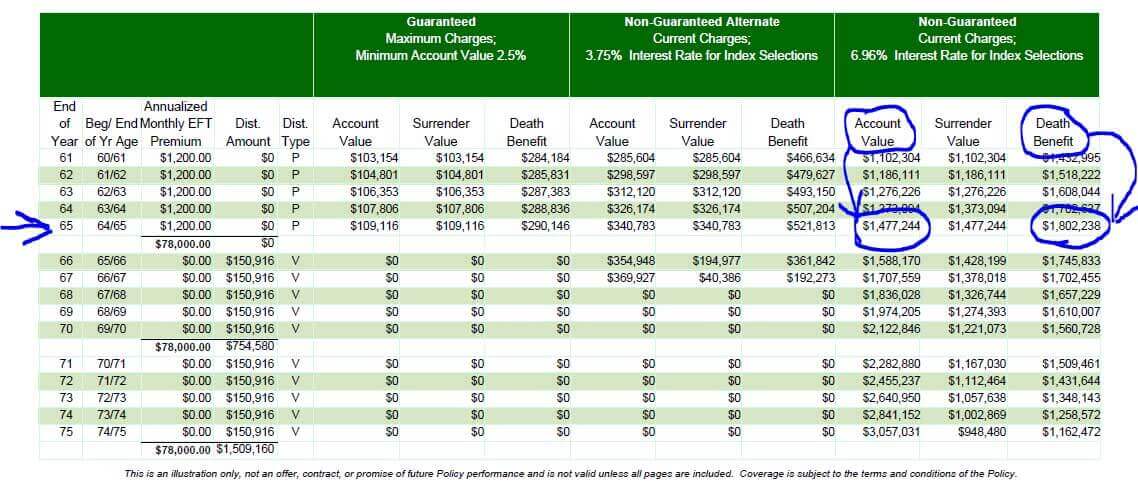

The remainder is included in the money worth of the plan after costs are subtracted. The money value is credited on a month-to-month or annual basis with rate of interest based on boosts in an equity index. While IUL insurance might show valuable to some, it is essential to recognize how it works prior to purchasing a plan.

Latest Posts

Cap Life Insurance

Universal Guarantee Life Insurance

Level Premium Universal Life Insurance